The cryptocurrency landscape has undergone significant transformations from January 2024 to January 2025, with notable shifts in institutional adoption, regulatory environments, and market dynamics. This analysis will explore key developments and their implications for investors and the global economy.

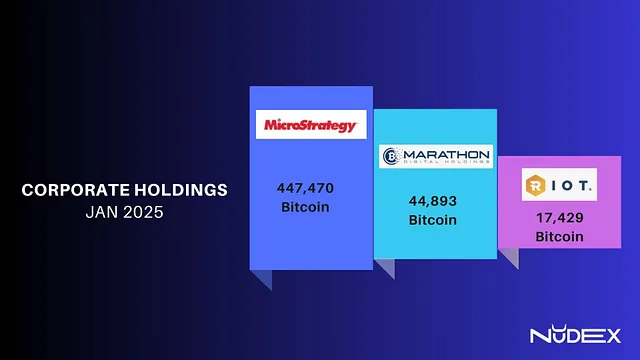

The trend of corporate Bitcoin acquisition is accelerating, driven by factors such as inflation hedging, portfolio diversification, and anticipation of future price appreciation. MicroStrategy’s aggressive accumulation strategy, particularly following the recent U.S. election, signals growing confidence in Bitcoin as a long-term store of value

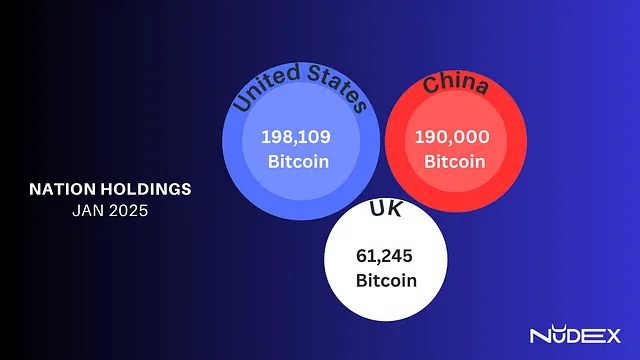

The significant Bitcoin holdings by major economies underscore the cryptocurrency’s growing importance in global finance. This trend could potentially influence monetary policies, international trade dynamics, and the balance of economic power in the coming years.

The approval of spot Bitcoin ETFs in January 2024 marked a turning point for institutional involvement. BlackRock’s iShares Bitcoin Trust (IBIT) has emerged as a frontrunner, attracting substantial inflows. With the new U.S. administration’s crypto-friendly stance, expectations are high for a more favorable regulatory environment. Key considerations for investors:

1.Regulatory developments and their impact on ETF structures

2.Liquidity and trading volumes of different ETF offerings

3.Fee structures and tracking error relative to spot Bitcoin prices

Geographically, North America leads in Bitcoin ETF exposure, followed by Europe. Emerging markets in Asia and Latin America are showing increasing interest, potentially opening new avenues for global Bitcoin investment.

The crypto market cap has grown significantly, reaching $3.26 trillion by January 2025. Bitcoin surpassed $100,000, while Ethereum maintained its position as the second-largest cryptocurrency.

Solana and Cardano showed strong performance.

Stablecoins, particularly Tether and USDC, gained prominence.

Latin America has seen substantial crypto adoption, driven by economic challenges and remittance needs. Argentina and Brazil are leading this trend, with Argentina’s crypto market expected to reach $728.2 million in 2025.

Southeast Asia and Europe (SEPA) are also experiencing increased crypto adoption, particularly in DeFi applications. The growth of play-to-earn games and crypto startups in these regions indicates a broadening acceptance of blockchain technologies.

The cryptocurrency market is entering what analysts term the “Infinity Age,” characterized by continuous growth and mainstream integration. With Bitcoin projected to reach $200,000 by the end of 2025 and institutional inflows into Bitcoin ETFs potentially surpassing $70 billion, the sector is poised for significant expansion.

However, investors should remain cautious of regulatory changes, market volatility, and the evolving competitive landscape among different cryptocurrencies and blockchain platforms.

What do you think about the rise of crypto adoption? Discuss your insights with friends eager to explore market trends and exciting opportunities!